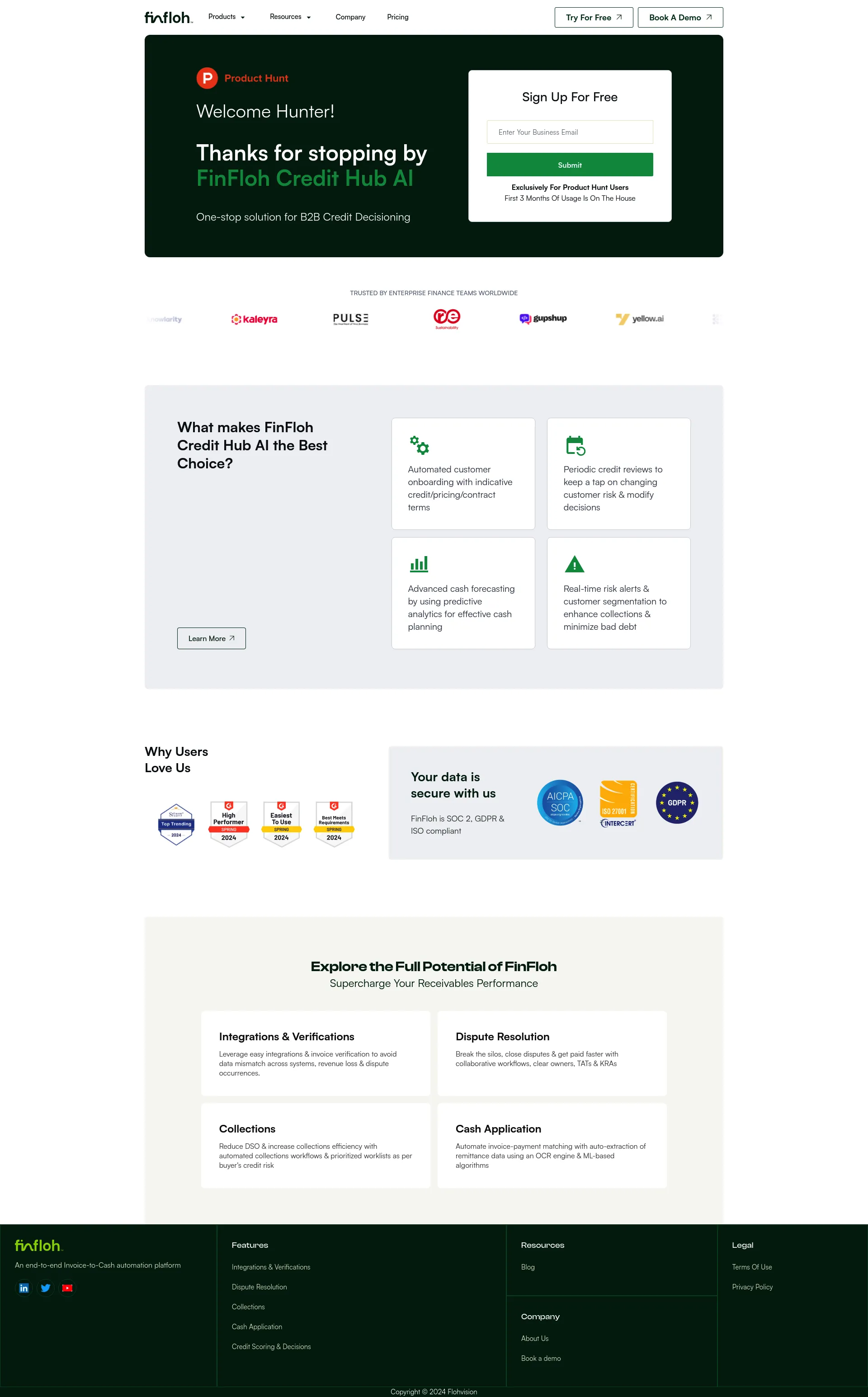

FinFloh Credit Decisioning AI streamlines B2B credit decisions with AI-powered accuracy. Integrate with CRMs like Salesforce for faster, smarter decisions across the customer lifecycle.

FinFloh is a comprehensive B2B credit decisioning solution that simplifies and accelerates the decision-making process. It leverages AI to predict risk and boost efficiency, helping businesses make smarter decisions on credit granting and customer management.

Businesses looking to optimize their credit operations and enhance risk management.