Finosu automates compliance for the credit industry, saving time and money for lenders, borrowers, and investors. Our software simplifies licensing, auditing, and loan management, making compliance a breeze.

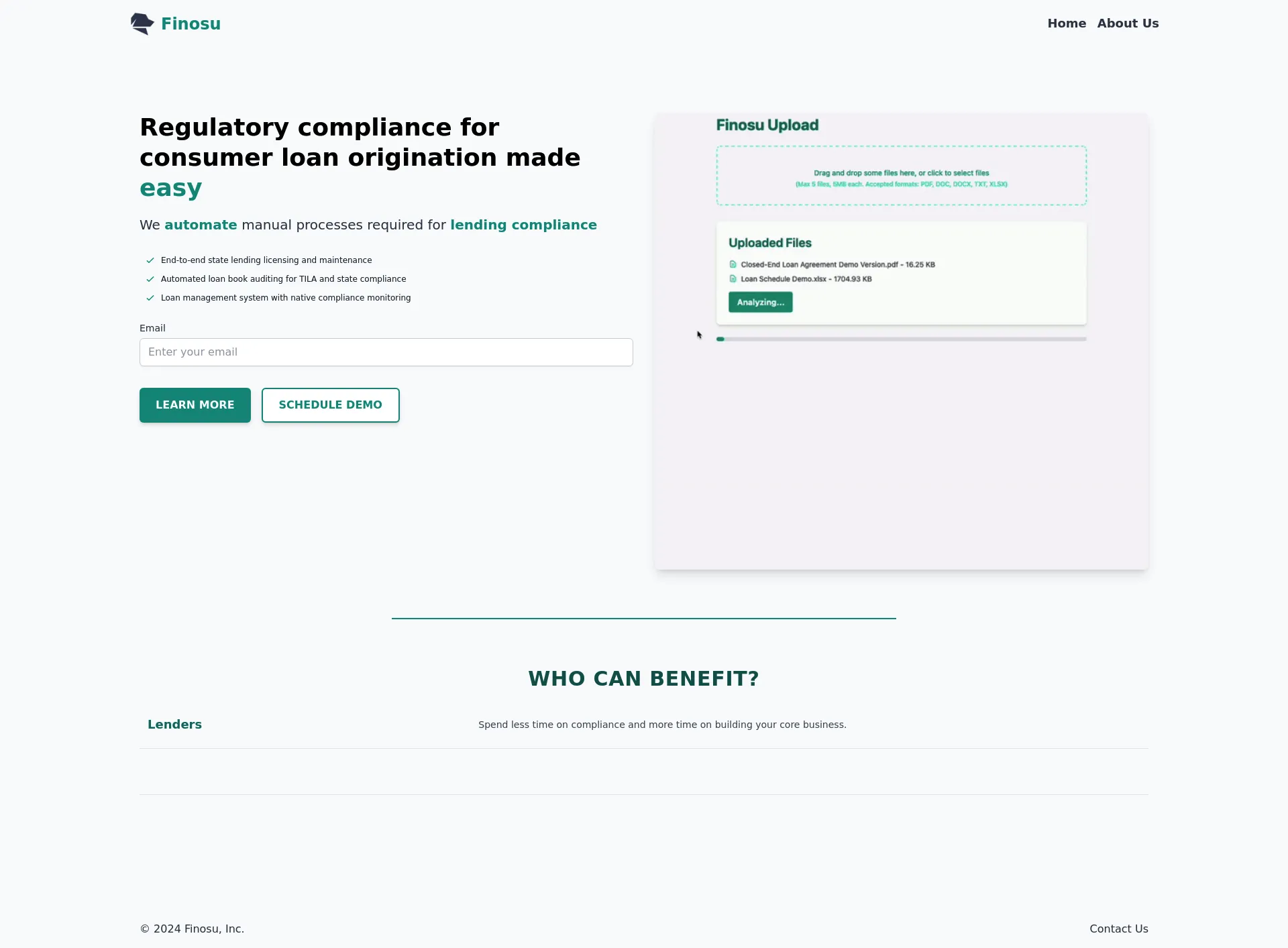

Finosu is a platform that simplifies regulatory compliance for consumer loan origination. It provides comprehensive solutions designed to automate manual compliance processes, saving lenders time and effort, allowing them to focus on their core business.

Finosu is designed primarily for lenders of all sizes, including banks, financial institutions, non-profit organizations, and commercial entities.