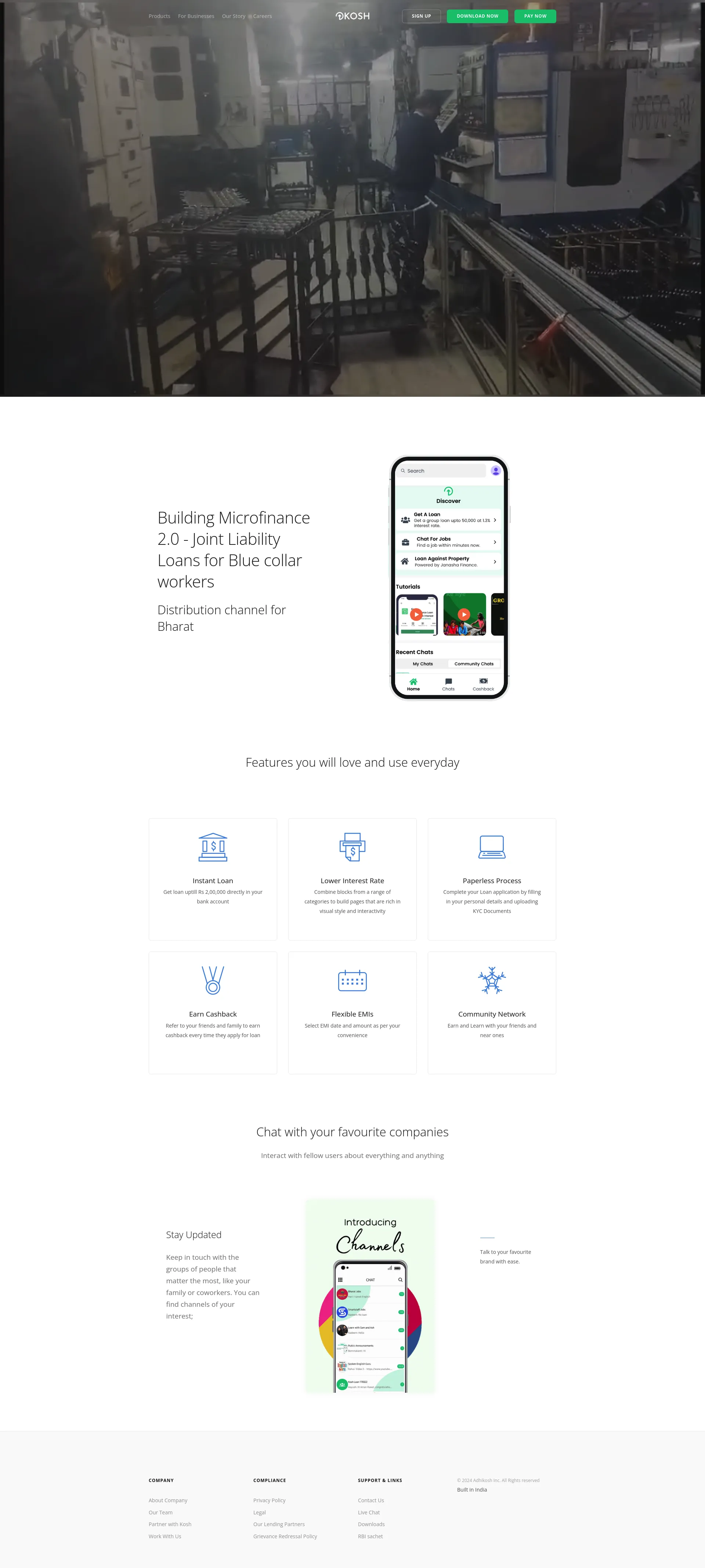

Kosh is a digital lending platform in India, empowering blue-collar workers with a unique joint liability model (much like microfinance but for a different segment). The social component of their underwriting helps control credit risk significantly and lower CAC/Opex in one go, making this 150mn-strong segment credit-worthy.

Kosh offers competitive interest rates and flexible EMI options tailored to your financial needs. Detailed pricing information is available upon application.

Kosh is powered by a dedicated team committed to revolutionizing microfinance for blue-collar workers. Our team works tirelessly to provide innovative financial solutions and exceptional customer service. Partner with Kosh to be part of a community-driven financial ecosystem.

We are fixing how money works.

Automating wealth creation for 400M Indian millennials

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS