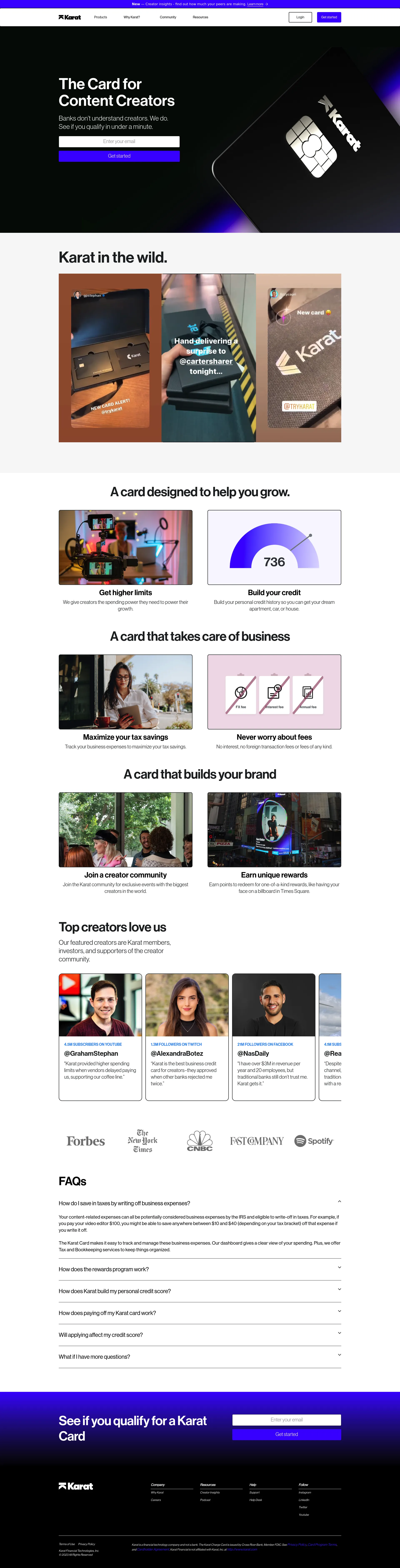

We're building the one-stop shop for creator finances. Your favorite digital creators—the ones you follow every day on YouTube, Instagram, TikTok or Twitch—aren’t just extraordinarily talented personalities and community builders. They’re also businesses. That means they have business needs—managing revenues, expenses, savings, credit, banking. We’re building products that help creators spend less time worrying about finances so they can focus on creating.

Karat is backed by a team of financial experts and creators who understand the unique challenges of the creator economy. Our mission is to provide tailored financial services that help creators grow and succeed.

The community building platform for creators & coaches

An AI-powered, all-in-one business platform for content creators

Design and build any kind of website. On your iPhone or iPad.

A social streaming platform powered by creators and fans

Book Series Marketing AI

Collaborative monetization platform for technical creators

Ad management for apps & web.

Financial connectivity API for consumer liabilities

Jemi helps people build beautiful websites and stores.

A bank as smart as your phone.

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS