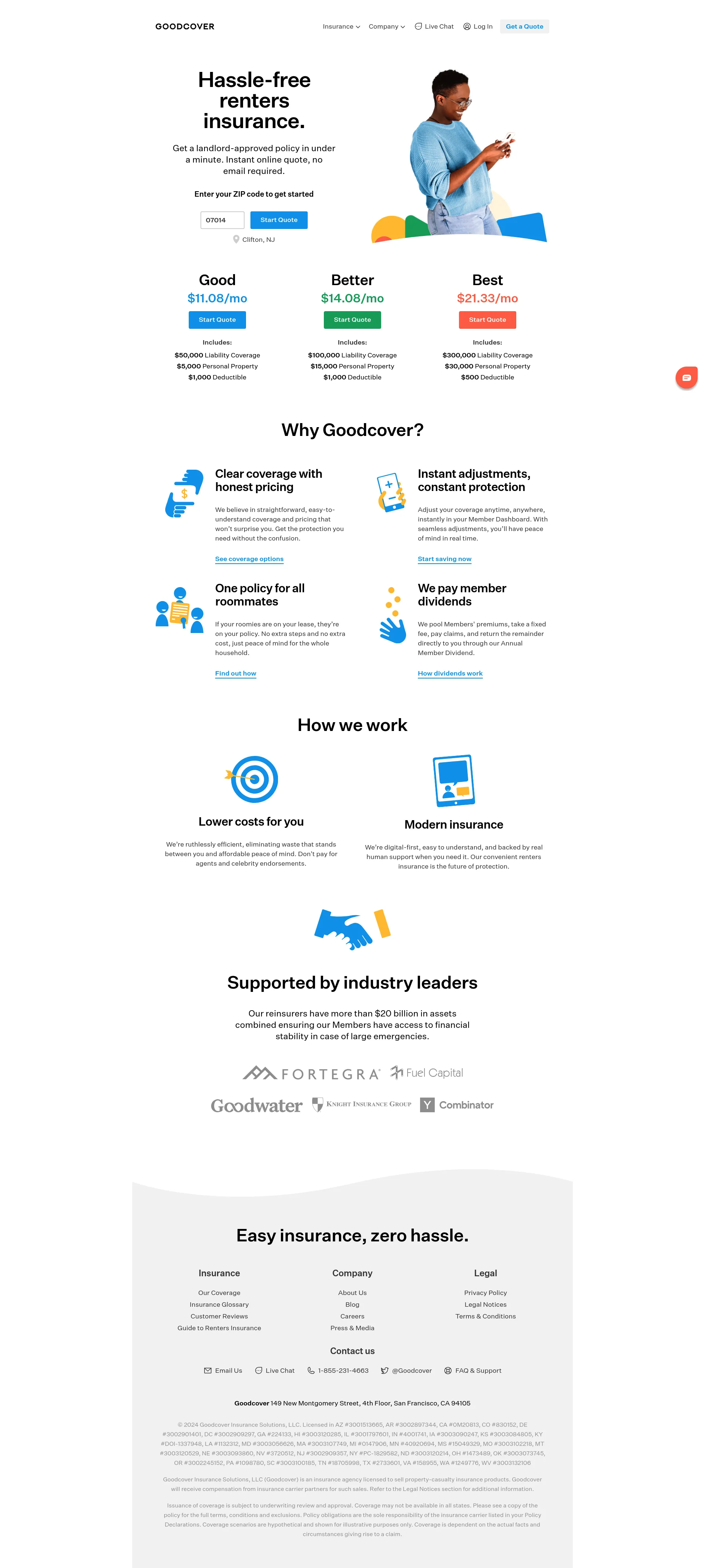

Goodcover provides its Members with Good Renters Insurance for 50% less than legacy companies and an Annual Dividend of the money left over after claims obligations are met. Goodcover is a Managing General Agent (MGA) that administers personal insurance on behalf of our Membership, a bit like how USAA does it. Member's premiums are pooled and used to pay claims. We take a fixed fee, and the remainder is returned in our Annual Member Dividend. We work with multi-billion dollar capital partners to ensure regulations are followed, adequate claims capital is always available, and we have emergency capacity for catastrophes. Technology allows us to eliminate waste, saving roughly 25% of the cost. We are 100% digital, but not bots - we invest in tech that enables our experts to help Members. As an Invitation Only Membership served by an MGA, we can give Members Free Insurance when they invite others, turning our "Marketing Budget" into savings for Members. This eliminates Lizards and Sales Agents, saving the other 25%. We do not use the standard industry models, instead using a multiperil model to more granularly price risk. This means that for a few of you we are more expensive... but everyone else pays much less than they would otherwise pay. Our granular, multiperil model allows us to offer a superior policy over the standard market including: - coverage for if your place is flooded by a neighbor - Replacement Cost Coverage (meaning new stuff for your old) - All Risk coverage for high value items you tell us about - including computers (almost no one does that amazingly) - added coverage for mold removal Our MGA business model allows us to be capital efficient, "renting" capacity as we need it. All this adds up to our government approved pricing being 40-60% cheaper on average than that of our competitors.

Goodcover is supported by industry leaders such as Fuel Capital, Knight Insurance Group, and Y Combinator. Our team is dedicated to providing modern, efficient, and affordable renters insurance, ensuring financial stability and peace of mind for our members.

Building a full-stack auto insurer for the underserved in LatAm

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS