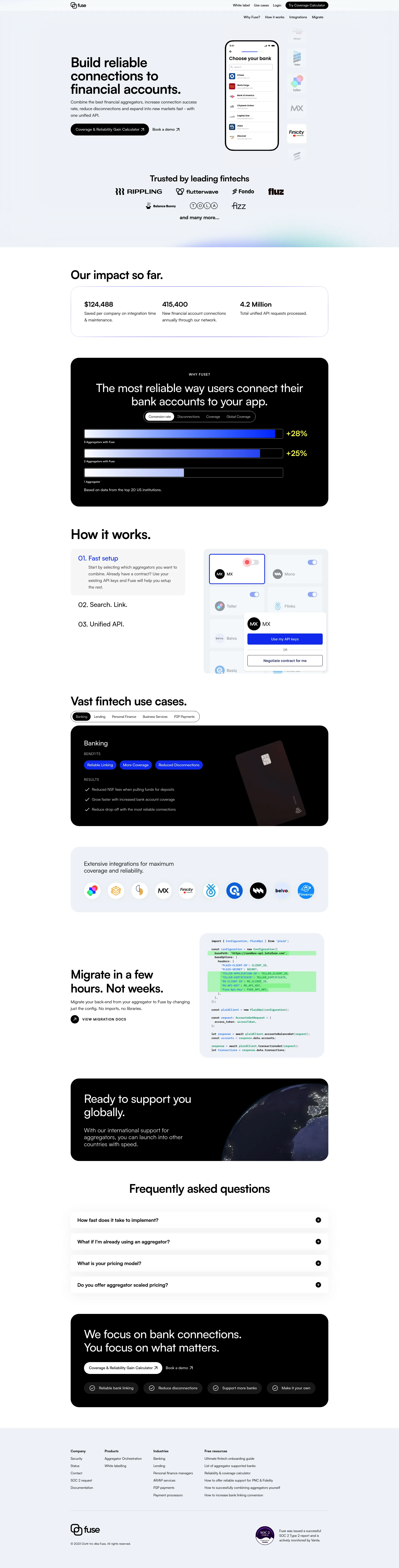

Fuse provides single API that integrates with multiple bank connection vendors, such as Plaid, MX, Teller, Finicity and Yodlee. Users can easily search for and select their bank via a drop-in component in your app, and then the most reliable bank connection vendor for that bank will be displayed. Fuse also provides a consistent data model for all bank integrations and handles the necessary data transformations and API quirks for you. By using Fuse, companies can improve the reliability of bank connections, reduce disconnections, and support more banks.

Fuse offers a unified API that combines the best financial aggregators to increase connection success rates, reduce disconnections, and expand into new markets quickly.

Fuse charges a percentage mark-up on top of your current aggregator cost. Scaled and custom pricing options are available for high-volume API calls or unique business models.

Fuse supports global teams with international aggregator support, enabling quick launches into new markets. The platform is designed for easy migration, allowing backend changes with minimal effort.

Fuse is trusted by leading fintech companies and has processed over 4.2 million unified API requests, saving companies significant time and resources on integration and maintenance.

An end-to-end digital banking solution for banks and credit unions

Embedded banking software platform and marketplace

Low-code integration platform for banking

Banking-as-a-service platform for Africa

The Unified API for Business Financial Data

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS