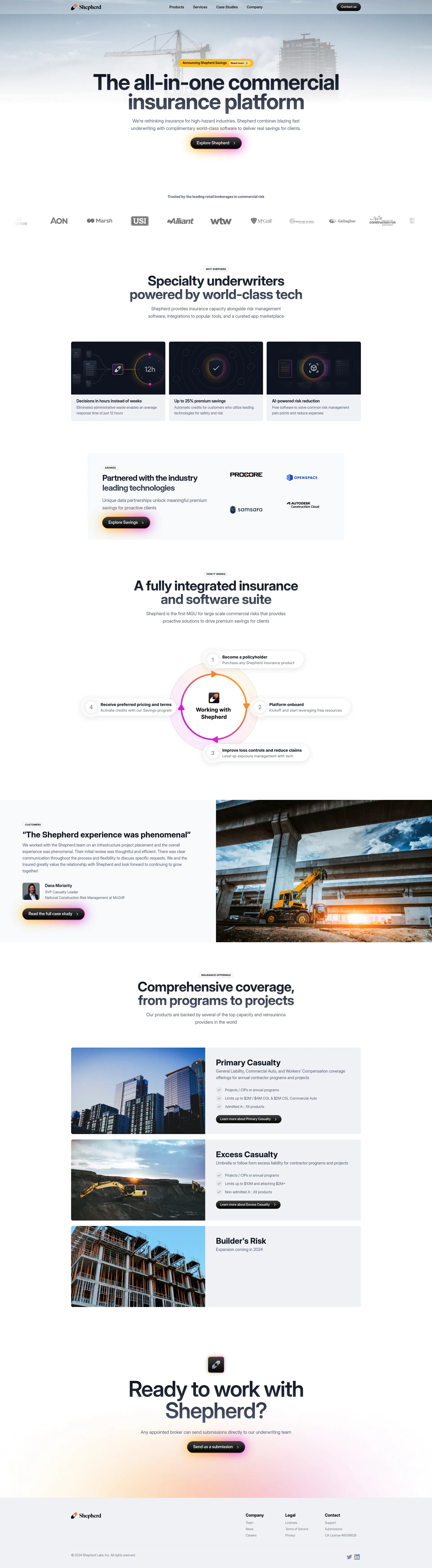

Shepherd Insurance is revolutionizing the insurance landscape for high-hazard industries by combining rapid underwriting with world-class software solutions, delivering significant savings and enhanced risk management for clients.

Shepherd offers competitive pricing with significant savings opportunities:

Shepherd's team consists of specialty underwriters powered by cutting-edge technology, ensuring efficient and thoughtful service. The team is dedicated to providing proactive solutions and maintaining clear communication throughout the insurance process.

Explore Shepherd Insurance today and experience the future of commercial insurance for high-hazard industries.

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS