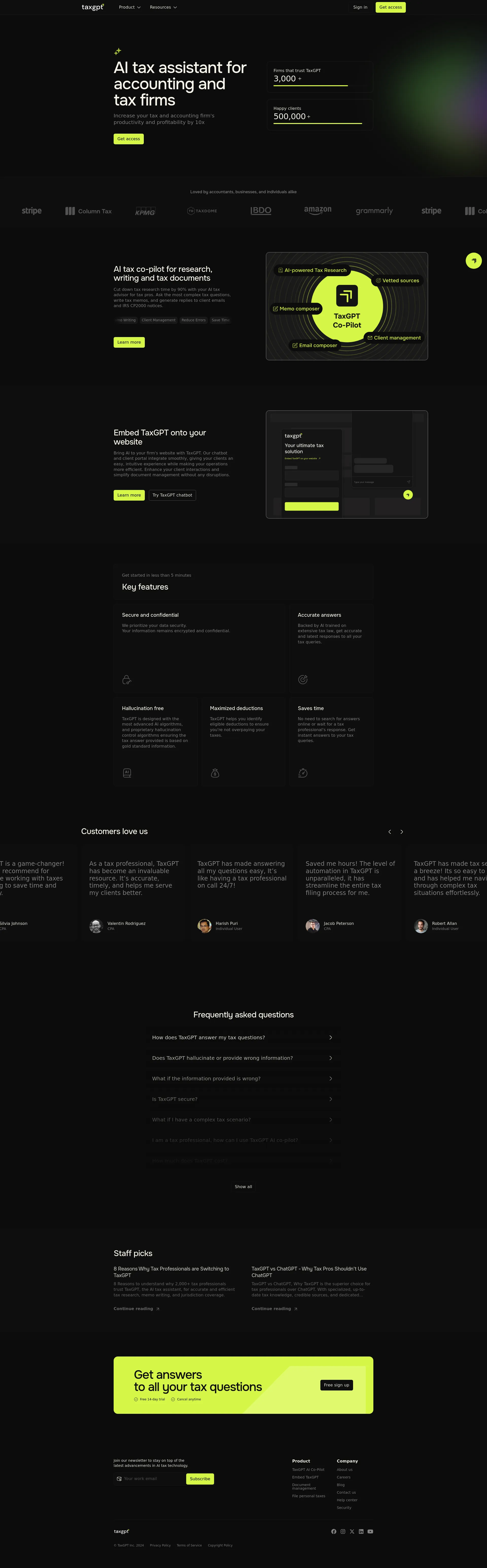

TaxGPT AI co-pilot for accountants and tax professionals increases tax firm's productivity and profitability by 10x by automating tax research, client communication, onboarding flows and secure document collection.

TaxGPT costs $1,000 per year per seat. This includes access to all federal, state, and international tax research without additional charges. Tiered pricing options and potential discounts are available for larger firms.

TaxGPT is trusted by over 15,000 tax professionals, including CPAs, EAs, and tax preparers. Our AI Co-Pilot significantly enhances productivity and accuracy, making it an invaluable resource for tax professionals and businesses alike.

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS