Say 'goodbye' to 'stare and compare' manual spreading of management accounts, tax returns, balance sheets, or P&Ls. Upload them to Heron via our portal, email, API and receive normalised, clean, and structured output piped directly to where you need it.

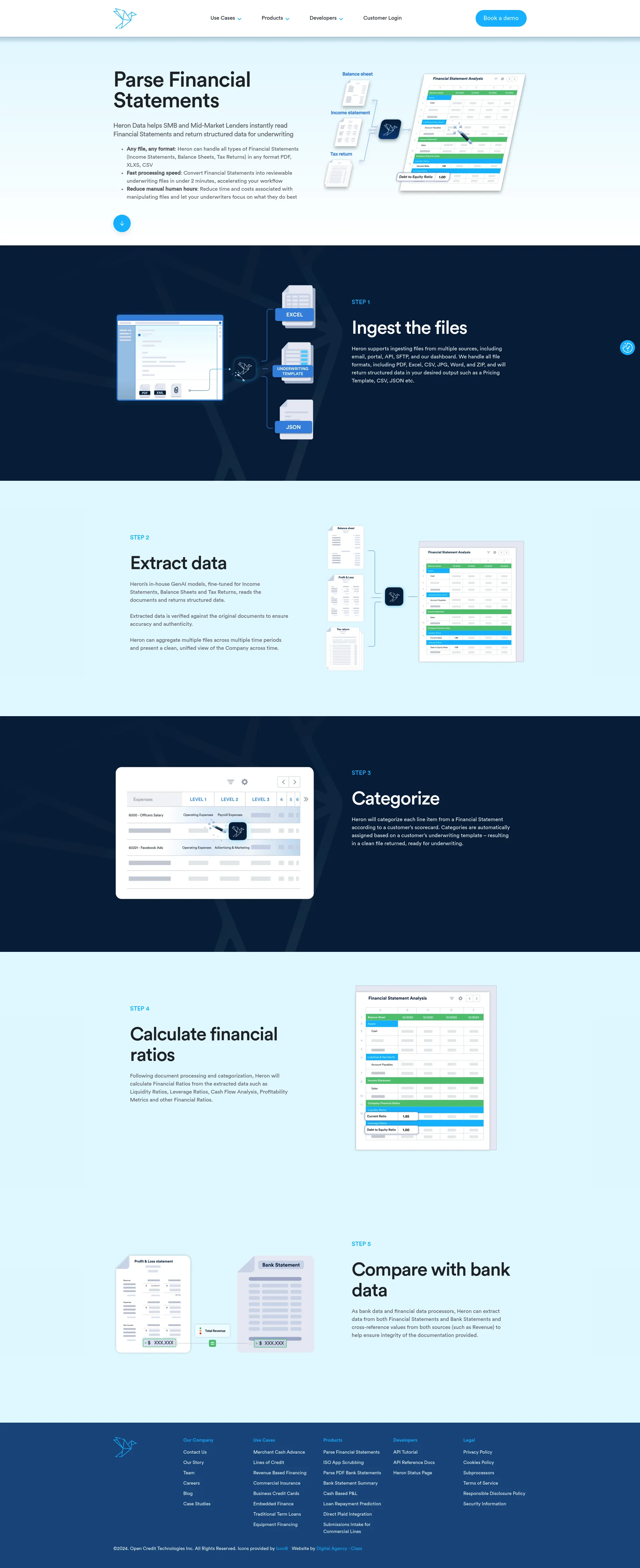

Heron Data helps SMB and Mid-Market Lenders instantly read Financial Statements and return structured data for underwriting. Our platform supports all types of Financial Statements (Income Statements, Balance Sheets, Tax Returns) in any format including PDF, XLXS, and CSV. With fast processing speeds, Heron converts Financial Statements into reviewable underwriting files in under 2 minutes, reducing manual human hours and allowing underwriters to focus on their core tasks.

Heron Data offers flexible pricing plans tailored to meet the needs of different businesses. Contact us for a customized quote based on your specific requirements.

Heron Data is powered by a dedicated team of experts in financial technology and data processing. Our team is committed to providing innovative solutions that streamline the underwriting process and enhance decision-making for SMB and Mid-Market Lenders.

Book a demo today to see how Heron Data can transform your financial statement processing and underwriting workflows.

A bank account that integrates LatAm SMEs' finances and operations.

All-in-one spend management for businesses in Latam

MIS on mobile for SMB's in India

Match with like-minded professionals for 1:1 conversations

Personalized web AI copilot

Transform your best writing and podcasts into LI and X posts

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Open source alternative to AWS