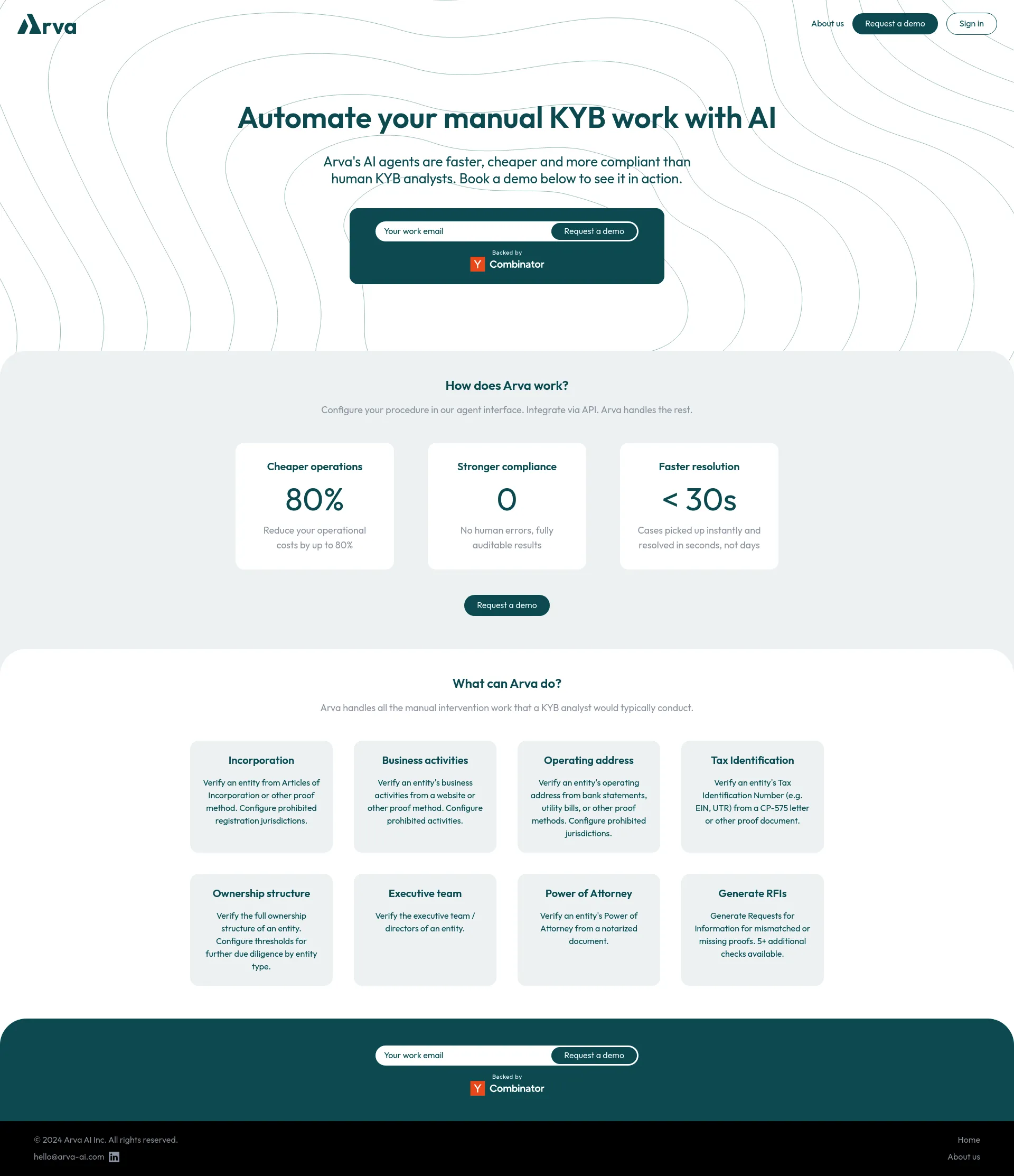

At Arva AI we automate the manual compliance checks that have to happen when a business signs up for a financial product, such as a business bank account. Currently, 30% of know your business (KYB) cases result in manual review work. With Arva's AI agents the whole end-to-end onboarding experience is automated, resulting in quicker, cheaper and more compliant low/medium risk reviews.

Contact us for detailed pricing information tailored to your specific needs.

Arva AI's team is dedicated to providing faster, cheaper, and more compliant KYB solutions through advanced AI technology. Configure your procedure in our agent interface, integrate via API, and let Arva handle the rest.

GenAI assistants for fintech risk and compliance operations

Shiboleth automates lending compliance for financial institutions…

AI-powered auditing platform

AI copilot to automate risk ops for fintechs and banks

Accend accelerates onboarding and KYC reviews for fintechs and banks

AI Agents for Banking

AI automation for enterprises

Business Idea Validation powered with AI

Supercharge your Backoffice Operations

The Financial Compliance Copilot

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS