Hi - Mark and Gab here! We met while working at Alt, a marketplace for collectibles, within which we built a $200m specialty finance business line. At Alt, we were faced with the mandatory regulatory compliance checks that are needed to make and manage consumer loans. And as a result, we spent much of our time and hundreds of thousands of dollars creating robust internal compliance tooling to ensure we were doing things the right way. However, after the pain of hunting through regulatory codes, confusion of form filling, surprise of regulatory deadlines, monotony of PDF data extraction, anxiety of brittle excel spreadsheets, and frustration of buried email threads with advisors … to name a few … we knew that this experience needed to be improved. So, we started Finosu to build the tools that we wish we had, so that we can make compliance risk for afterthought in the credit ecosystem. Finsou is building software to solve regulatory compliance challenges in credit, beginning with: consumer lending licensing, consumer loan book auditing, and default compliant loan management systems. The cost of credit compliance reaches into the tens of billions a year and that is money out of the pocket of lenders, borrowers, investors, and ultimately the consumers as a cost of doing business – we are changing that.

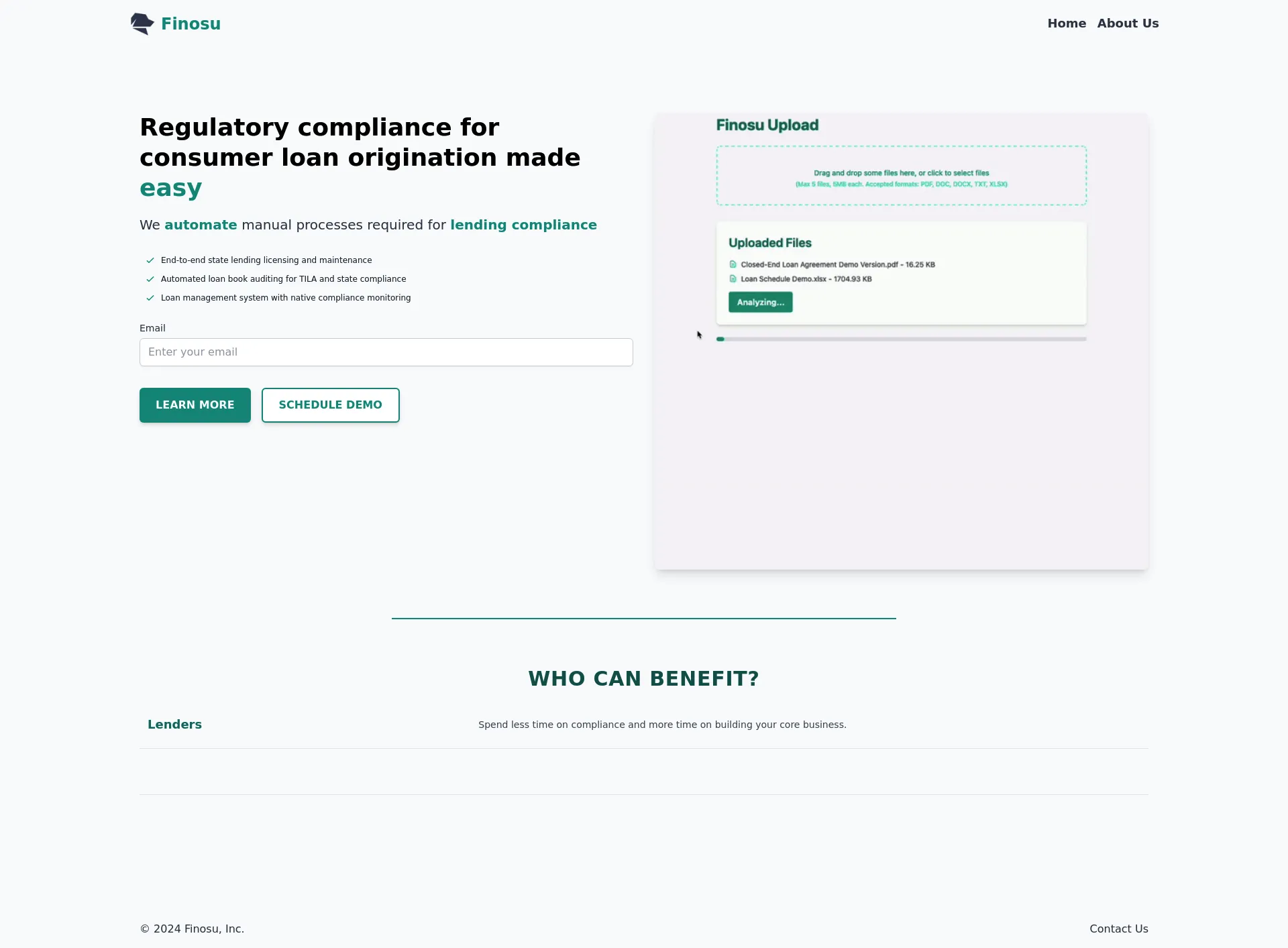

Finosu automates manual processes required for lending compliance, ensuring seamless regulatory adherence for consumer loan origination.

Contact us for detailed pricing information tailored to your specific needs and business size.

Our dedicated teams at Finosu are committed to providing top-notch regulatory compliance solutions, ensuring that lenders, investors, and auditors can focus on their core activities without worrying about compliance issues.

Shiboleth automates lending compliance for financial institutions…

Stripe for Credit - End-to-end credit infra via API

Intelligent Process Automation for Lending.

GenAI assistants for fintech risk and compliance operations

The Financial Compliance Copilot

Financial connectivity API for consumer liabilities

AI copilot to automate risk ops for fintechs and banks

Jenfi provides revenue-based financing for digital businesses in Asia

Loan management software for private lenders

Automate document processing with GenAI in seconds

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS