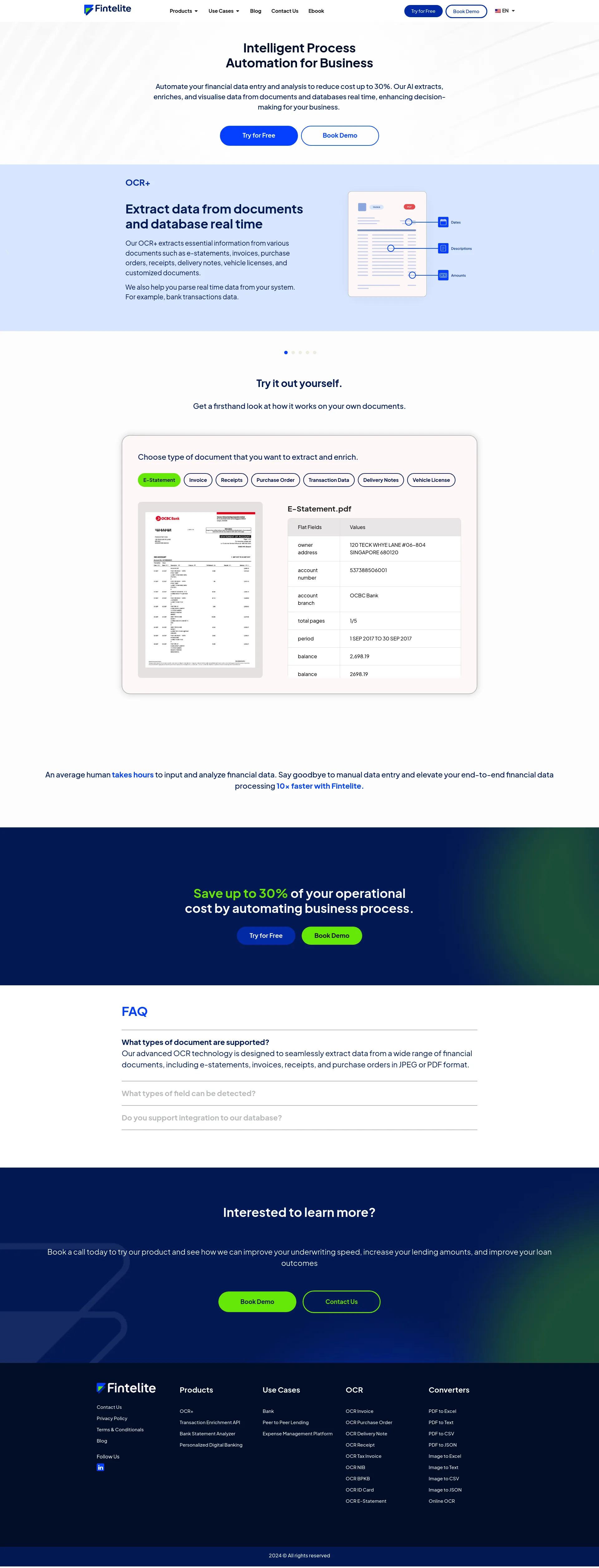

Fintelite's AI streamlines loan approvals and fraud detection, ensuring swift, accurate decisions. Revolutionizing lending with AI-powered bank statement analysis and transaction data enrichment. Fintelite empowers lenders with a next-generation approach to lending. Our AI platform utilizes: Bank statement analysis: Gain deep insights into borrower financials through automated analysis. Transaction data enrichment: Extract valuable details from transactions for a holistic financial picture. These capabilities enable lenders to: Reduce fraud: Identify and prevent suspicious activity with superior accuracy. Accelerate approvals: Make faster, data-driven decisions with enriched information. Optimize risk management: Tailor risk assessments based on comprehensive borrower data. Passionate about building a future of responsible AI in financial services. I'm committed to helping lenders serve customers efficiently and securely. Our help to others includes: • BlubyBCA and ANZ increased efficiency by 15% • Qazwa and KoinWorks sped up loan processing 10x, cutting costs by 25%

Fintelite AI is transforming the financial services industry with cutting-edge AI solutions designed to automate and enhance financial data processing. Our platform extracts, enriches, and visualizes data from various documents and databases in real-time, significantly improving decision-making and operational efficiency.

Fintelite AI offers flexible pricing plans tailored to meet the needs of various businesses. Contact us for a customized quote and to discuss your specific requirements.

Our dedicated team of experts is committed to providing top-notch AI solutions to revolutionize financial services. We work closely with our clients to understand their needs and deliver solutions that drive significant business value.

Book a demo today to see how Fintelite AI can transform your financial operations.

Financial connectivity API for consumer liabilities

Loan management software for private lenders

CorgiAI is payment fraud prevention software for ecommerce, travel…

GenAI assistants for fintech risk and compliance operations

Enriched transaction data you can build on

Lending Intelligence Software

AI copilot to automate risk ops for fintechs and banks

We make it fast & easy to give credit to businesses

AI Agents for Banking

Compliance automation for the credit industry

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS