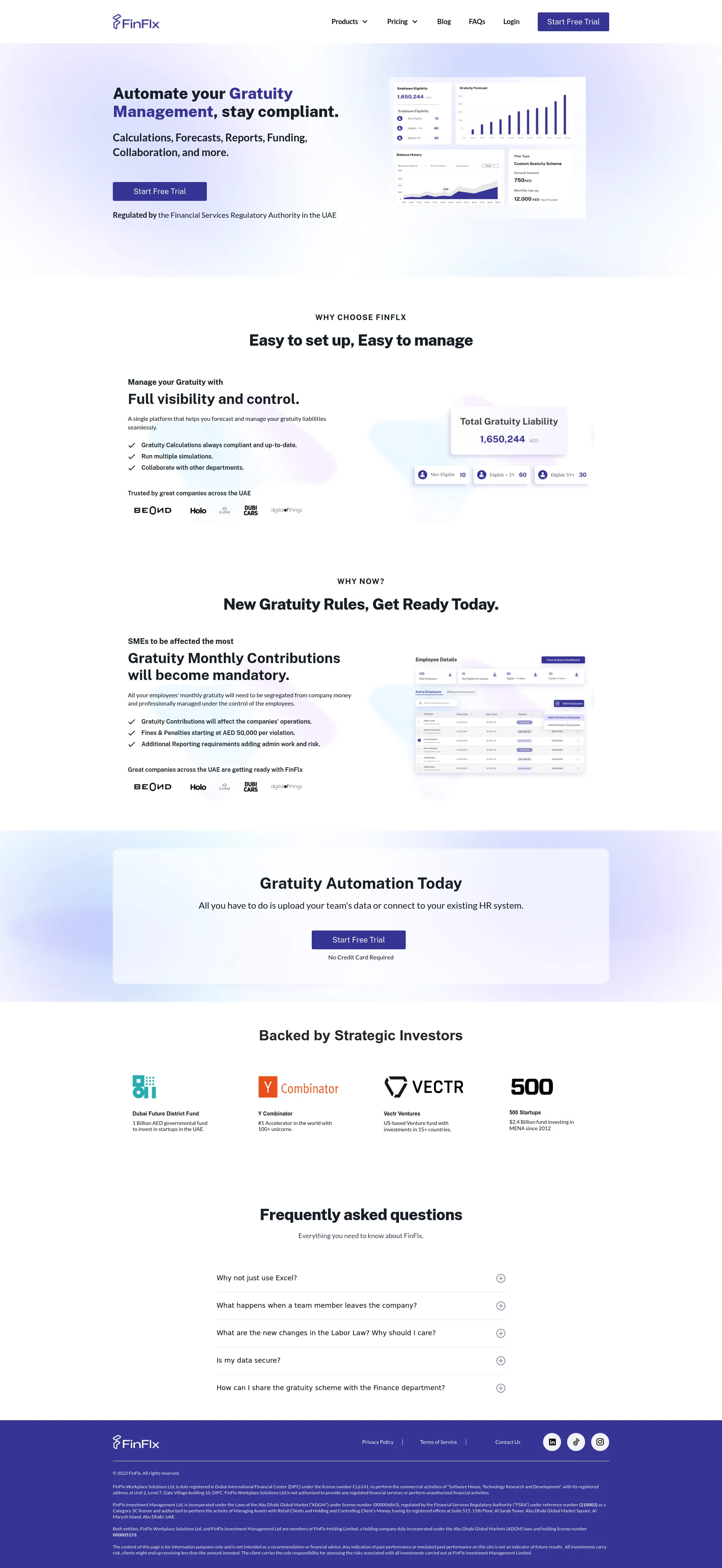

FinFlx makes it easier and more affordable for SME to offer defined contribution pension plans in line with local labour laws. Employers can launch a pension plan within hours instead of weeks, with fully digital employee record management, plan administration, investment selection and detailed reporting. FinFlx is the future of workplace retirement solutions in the Middle East.

FinFlx is backed by strategic investors including Dubai Future District Fund, Y Combinator, Vectr Ventures, and 500 Startups. Our team is dedicated to providing a seamless and compliant gratuity management solution for companies across the UAE.

Financial planning software for startups

Empowering Faster & Smarter B2B Credit Decisions, Every Time

Your New Go-To For Managing Money

Match with like-minded professionals for 1:1 conversations

Go from Slack Chaos to Clarity in Minutes

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI Assistants for SaaS professionals

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Smooth payments for SaaS