Powered by a ML-driven dynamic credit decisioning algorithm, FinFloh enables businesses with AI-driven accurate credit/contract/pricing decisions across customer lifecycle, esp. during customer onboarding integrated with CRMs like Salesforce.

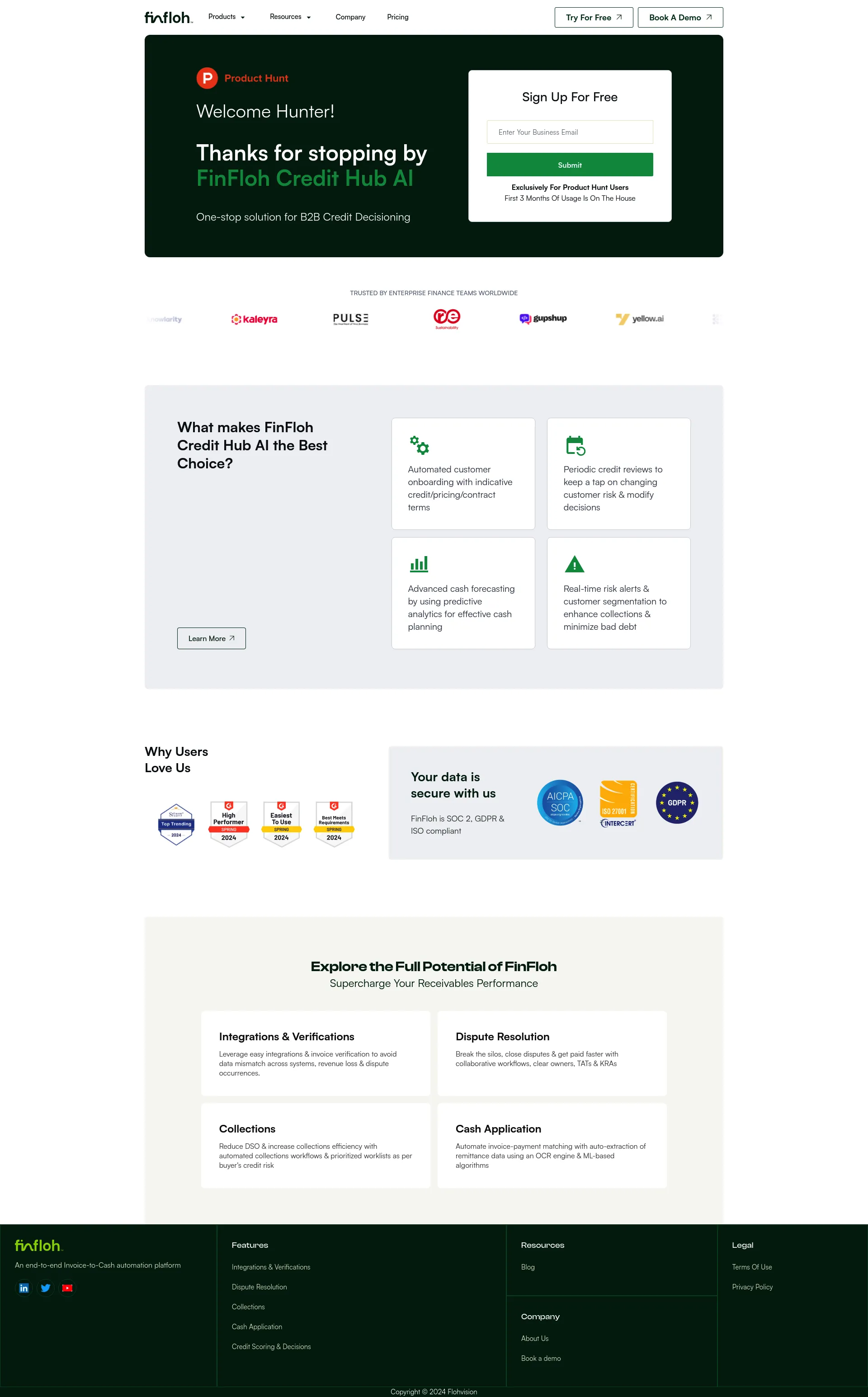

FinFloh Credit Hub AI is an all-in-one platform designed to streamline B2B credit decisioning. Trusted by enterprise finance teams worldwide, it offers a comprehensive suite of tools to enhance your receivables performance.

Exclusively for Product Hunt users, the first 3 months of usage are free. Contact us for detailed pricing plans tailored to your business needs.

FinFloh is designed for enterprise finance teams looking to supercharge their receivables performance. Our platform is SOC 2, GDPR, and ISO compliant, ensuring your data is secure with us. Explore the full potential of FinFloh and transform your credit decisioning process.

Intelligent Process Automation for Lending.

Financial planning software for startups

AI-powered financial research assistant for data-driven decisions

Turn your knowledgebase into AI chat, in 2 minutes

GenAI assistants for fintech risk and compliance operations

Flexible Workplace Savings plans for SMEs in MENA.

AI-Powered Knowledge Base for Customer Support

AI-powered equity research software

Compliance automation for the credit industry

Unit Economics on autopilot

Match with like-minded professionals for 1:1 conversations

Personalized web AI copilot

Transform your best writing and podcasts into LI and X posts

Personalize 1000s of landing pages in under 30 mins

The first LLM for document parsing with accuracy and speed

AI-powered phone call app with live translation

Delightful AI-powered interactive demos—now loginless

AI Motion Graphics Copilot

Pop confetti to get rid of stress & anxiety, 100% AI-free

Open source alternative to AWS